Need a Homeowners Insurance Quote in Willard?

If you’re like most homeowners in Willard, your home is your most valuable asset. When your home becomes damaged , you need your claim settled by an insurance company that gets the importance of the place you call home. In other words this is why we purchase home insurance!

Millennium Brokers can help you find homeowners insurance that can best meet your needs. We can provide you a valuable combination of coverage, quality service and competitive pricing.

Regardless of whether you live in Willard or any other part of Missouri, homeowners insurance is one of the most important insurance policies you could ever own.

Get Your Free Quote Started!

Willard Homeowners Insurance

If you’re not using an independent agent in Willard like us, it can be hard, if not impossible to tell the difference between two homeowners policies.

Whether you own or rent, insuring the place you call home can help protect you if you suffer a finical loss due to fire, theft, vandalism, or other covered events. It can also provide you coverage when a guest gets injured while on your property and wins a legal judgment against you.

Homeowners insurance policies differ by what losses they cover, the coverage you choose, and what type of home you own or rent. You choose which policy is best for you. From a comprehensive policy that covers losses such as fire, hail, smoke, falling objects, vandalism and theft of personal property. To a policy that covers only specified losses listed in the policy.

Save even more with homeowners insurance discounts.

Once you get a home insurance quote through the Millennium Brokers Insurance Agency, you will see how affordable it can be. With many discounts, we can help get you the coverage you need to likely save you even more on your home insurance policy.

Multi-Policy

When you have a car insured with the same company as your homeowners insurance policy, you can get a discount on both your home and car insurance.

Home Security Systems

If you have installed an Alarm system, you should be getting a discount.

Age of Home

Do you owner a newer home? Newer homes can help qualify you for a new home discount.

Occupation

When purchasing your home insurance through the Millennium Brokers Insurance Agency, we can sometimes get you special discounts for just having a certain job.

Roof

If you have a newer roof or certain types of roofs, you might qualify for a roof discount.

Employer

Did you know that your Employer might qualify you for a special discount? When purchasing a home insurance policy through the Millennium Brokers Insurance Agency, certain companies will offer employer based discounts.

Quick Navigation Guide to Home Insurance

What does my Homeowners Insurance Cover?

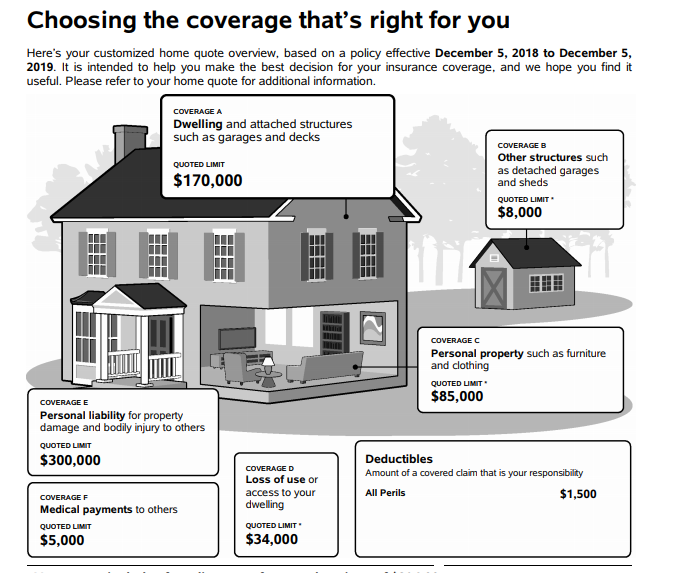

Dwelling — this is the part of your policy that covers the dwelling. The cost to replace your home can fluctuate from time to time. This can vary due to the cost of raw material and labor to rebuild your home.

Other Structures — this covers most structures on your property that are not permanently attached to your house. This could include fencing, driveways, sidewalks, and detached buildings like sheds and garages. Furthermore, this coverage is 10% of your Dwelling limit but it can be increased.

Personal Property — this covers belongings like clothing, furniture, electronics, and appliances. Basically anything that would fall out of your house if you turned it upside down and shook out the contents.

Loss of Use — this can give coverage for temporary extra expenses you may have because your insured home is unlivable after a loss your policy covers.

Medical Expense —this can provide limited medical expense coverage for guest who gets injured on your property. In certain cases it can coverage injury to others off of your property. In contrast, it does not provide coverage healthcare costs for you or other members of your household.

Family/Personal Liability — this typically provides a set amount of coverage for specific type of injury that you cause to others. This can also provide coverage for damage to others property. When choosing your liability coverage limit, consider things like how much money you make and the things you own.

Endorsements & Additional Coverages

The other important thing to keep in mind is there are additional coverages you may want/need on your homeowner’s insurance policy. A good idea would be to call your local agent to find out if any of the below coverages would be of value to you.

- Scheduled Jewelry/Fire Arms/Fine Arts etc Protection

- Extension to a Secondary Residence

- Identity Theft

- Water Back Up of Sewer or Drains

- Tree Removal Coverage

- Mold Limited Fungi Coverage

- Watercraft/Jet Ski Coverage Option

- Business in the Home

Things to Know When Purchasing Home Insurance

- Your agent should have done an estimated replacement cost. This is important in making sure you are covered properly.

- Flood Insurance is now included.

- Earthquake is not automatically included.

- Pick a deductible that works for your budget and your family

- What happens if you need to file a claim? Make sure you have a plan in place with your agency team.

Will bundling my home and auto insurance save money?

Pros

Bundling discounts will vary but generally range from 5% to 25%.

Your coverage can be reviewed in one setting. In addition, you don't have to worry about dealing with two different companies.

Having multiple policies under one roof can sometimes make you look more favorable to an insurer. Likewise, this may help you get access to different discounts besides just the bundle like longevity, accident forgiveness ect. It is important to remember this will vary by company.

Cons

Bundling can make it harder to shop your rates.

There are times when one company has a cheap home insurance price while another has a cheap auto insurance price. As a result, it can be more expensive .

Insurers may choose to place you with an affiliated company if they can't offer you coverage. Consequently, this can negate some of the advantages of bundling.

What if my Home Insurance is Escrowed?

This is not a problem at all. We try to make the process as simple as possible. Generally, we are able to get your home loan company billed without any problems. In fact, sometimes this can make it easier on a year to year basis. As a result, this can make the renewal process simple and easy.

Further, in most cases we will just need to know your loan company and the loan number. Some mortgage holders might require you to call in to verify that you switched your insurance. As a result, each year in the future, you lender will take care of paying the insurance premiums out of your escrow account.

I am in the middle of my policy. Can I still switch?

In most cases, you can switch without facing a penalty. As a result, you might be able to save some money! Usually in Missouri, the company will return any unearned premium for insurance that you had already paid. For example, if you had paid 1,000 for a home insurance policy and switched halfway through the year, you would likely see $500 back.

Some companies might have a minimum earned premium or a small penalty but this isn't as common. At Millennium Brokers, we considering a switch, we recommend calling your current company and asking.

What is an Insurance Broker?

An insurance broker is someone who can sell insurance through multiple companies. For example, an insurance broker can offer insurance policies for multiple homeowners insurance companies rather than just one. As a result, sometimes this may help you find a more favorable rate or a policy that better fits your needs.

A captive agent typically only has the ability to sell through one or limited companies. Consequently, they have limited choices unlike an independent insurance agent also known as a broker. The broker has the ability to pick and choose what companies he or she decides to work with.

Do you offer auto insurance?

Our agency goal is to be able to serve as many needs for our clients as possible. As a result, auto insurance is one of the many services that we offer for our clients. Similar to home insurance, we work with over 15 auto insurers to help find a policy that fits your needs.

We also offer a variety of other products including:

- Life Insurance

- Business Insurance

- Medicare Supplement

- Advantage Plans

- Dental Insurance

- Disability Insurance

- Flood Insurance

Why Buy Home Insurance from Millennium Brokers?

At Millennium Brokers we are on of the top reviewed Home Insurance Agencies near Willard, Missouri. We work with over 50 Auto, Home, Life and Business Insurance Carriers. In addition, our staff is dedicated to make sure we are able to provide top notch customer service. Above all our goal is to cover each and every customer in the same way we would cover our own family.

5-Star Google Reviews

Millennium Brokers

Is A Top-Rated

Agency

5-Star Facebook Reviews

Get Started With Your Willard Home Insurance Quote

Every home is unique, and that means they need a carefully crafted policy. No only can we save you money but also time. You should have to spend all day calling multiple agents when you can can get multiple rates all in one place. Furthermore, we provide the local customer service that many customers want.

If you’d us to review your current policy and provide you a no obligation quote, call our office, or head over to our Quotes page. You can also click the home insurance quote button below to get your quote started within minutes.