Grandview Missouri

Grandview, Missouri, is a south Jackson County city just south of Kansas City, known for the Truman Farm Home and redevelopment along the I-49 corridor. It has about 26,000 residents (the 2020 Census counted 25,204). The community offers suburban neighborhoods, parks, and strong regional access. At MBG, we specialize in home insurance in Grandview and the surrounding Communities.

How much does Home Insurance Cost in Missouri?

The average reported home insurance cost in Missouri varies by source but generally runs between $1800 to $2600. This slightly higher than the National Average likely due to the large presence of hail. Actual pricing varies depending on the size and location of your home along with other factors.

What Are The Key Parts of Home Insurance

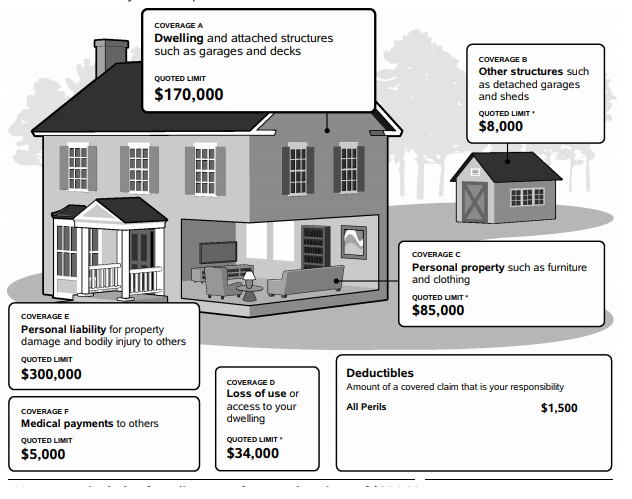

Dwelling — this is the part of your policy that covers the dwelling. The cost to replace your home can fluctuate from time to time. This can vary due to the cost of raw material and labor to rebuild your home.

Other Structures — this covers most structures on your property that are not permanently attached to your house. This could include fencing, driveways, sidewalks, and detached buildings like sheds and garages. Furthermore, this coverage is 10% of your Dwelling limit but it can be increased.

Personal Property — this covers belongings like clothing, furniture, electronics, and appliances. Basically anything that would fall out of your house if you turned it upside down and shook out the contents.

Loss of Use — this can give coverage for temporary extra expenses you may have because your insured home is unlivable after a loss your policy covers.

Medical Expense —this can provide limited medical expense coverage for guest who gets injured on your property. In certain cases it can coverage injury to others off of your property. In contrast, it does not provide coverage healthcare costs for you or other members of your household.

Family/Personal Liability — this typically provides a set amount of coverage for specific type of injury that you cause to others. This can also provide coverage for damage to others property. When choosing your liability coverage limit, consider things like how much money you make and the things you own

What Does Grandview Missouri Insurance Not Cover?

Unfortunately, it is unrealistic to expect homeowners insurance in Grandview, Missouri to offer coverage for all the unfortunate events that can happen at your home. In simple words, an insurer won’t cover you if you damage your house intentionally and claim a reimbursement.

Additionally, there are also some other causes that this insurance excludes:

- Flooding, including sewer backup and drain

- Earthquakes, sinkholes and landslides

- Infestations by vermin, mold, birds, and fungus

- Neglect or Wear and tear

- Nuclear hazard.

- Government action, such as war.

Sometimes you can coverage for these causes, but you have to purchase them insurance separately. For example, there is earthquake and flood insurance for people living in areas that suffer from these disasters repeatedly.

In addition, there is another way to expand any coverage and that is through endorsements. They cost more, but you can communicate with your insurer and get them added for expansive coverage.

Grandview Home Insurance Deductibles

Traditionally, homeowners insurance in Grandview deductibles were often $1,000 or $1,500. Today, many insurers in Missouri use a separate wind and hail deductible, set as a percentage of your home’s replacement cost. This wind/hail deductible is separate from your all-peril deductible.

Example:

- Replacement cost: $500,000

- Wind/hail deductible: 1%

- Calculation: $500,000 × 1% = $5,000

- Deductible for a wind or hail claim: $5,000

Ways To Lower My Home Insurance Cost?

Shopping for Home Insurance can be overwhelming if you don't use MBG. Our team helps you find shop around without having to sacrifice coverage. If your looking to lower costs here are some quick ways:

- Raise Deductibles

- Bundle with Other Policies

- Remove Coverages You Don't Need

- Get A New Roof

- Shop with An Insurance Broker

Major Missouri Cities We Serve

MBG specializes in many different types of insurance but our specialty is homeowners insurance. Here is some of the major cities we serve: